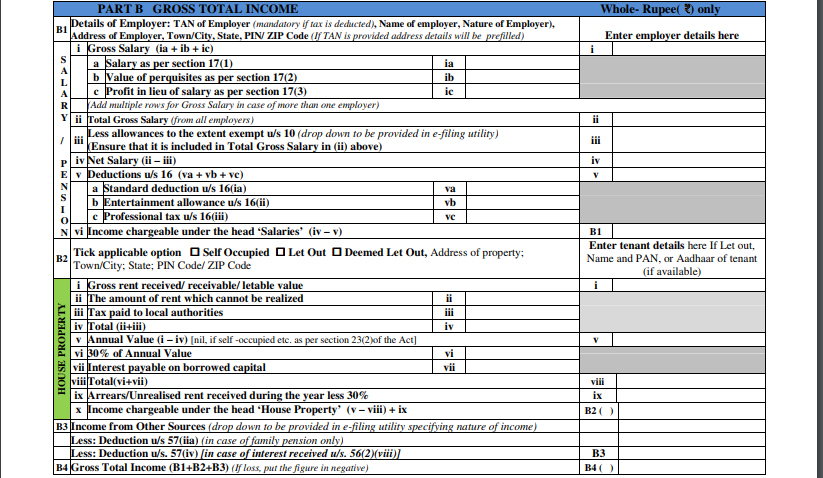

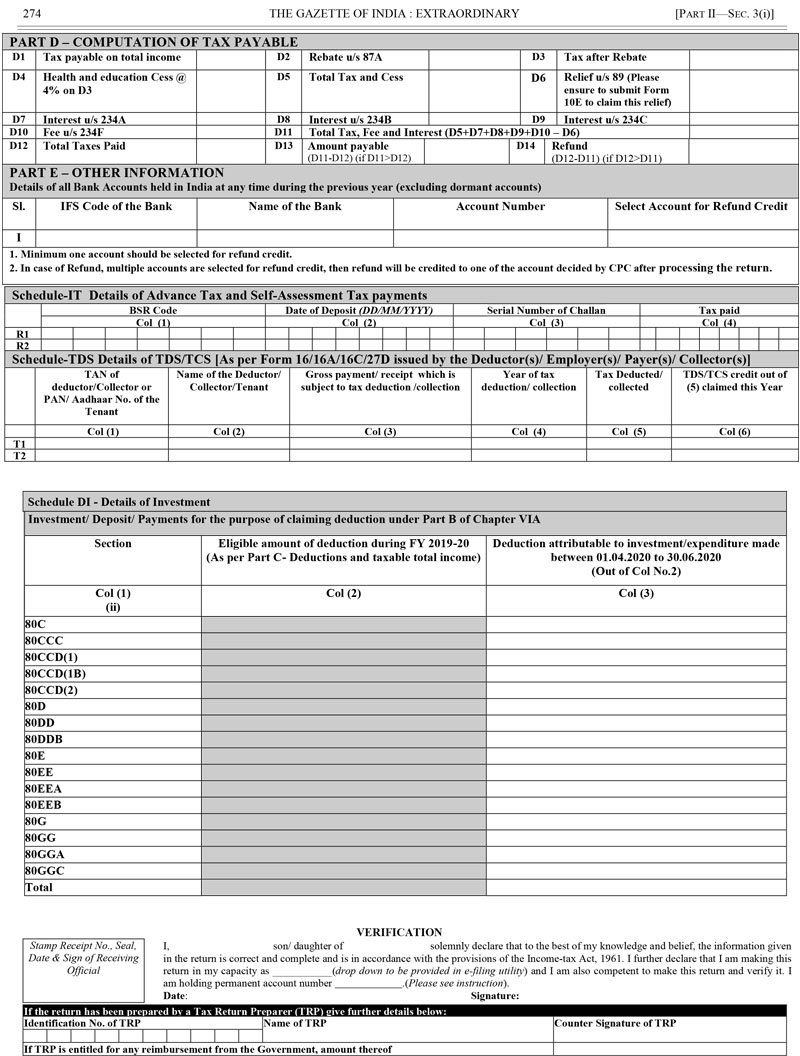

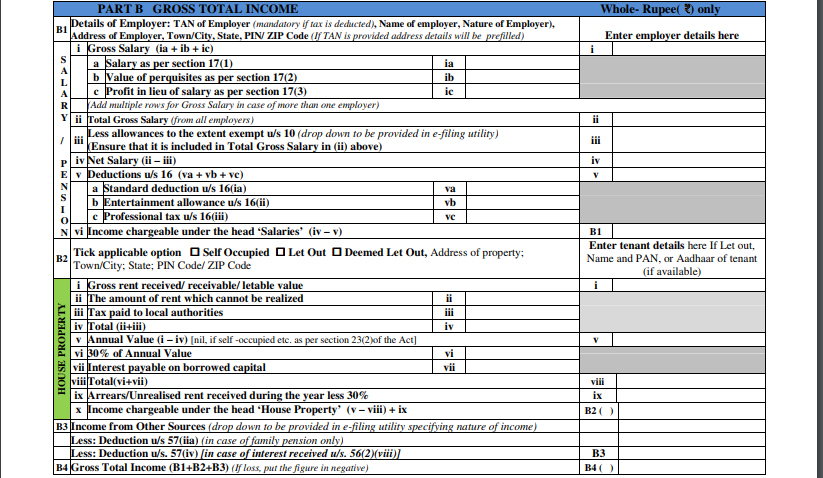

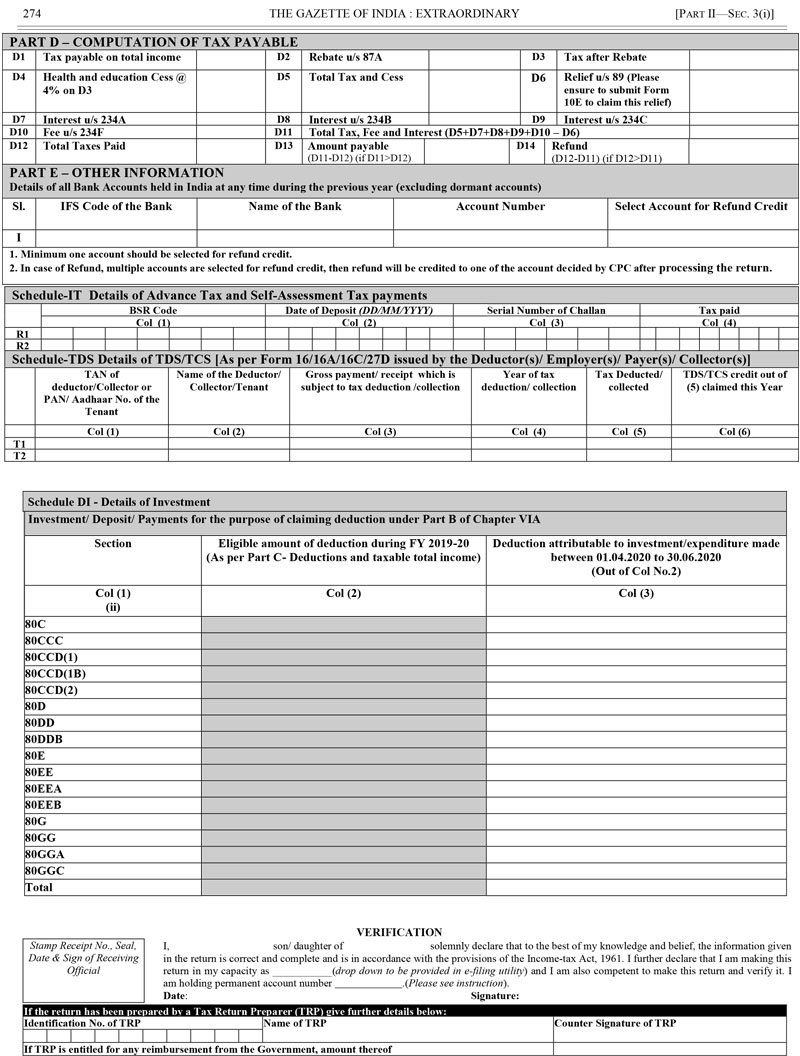

E-Verification Scheme of CBDT is another initiative facilitating voluntary compliance. Advisory for the taxpayer wishing to register as One Person Company in GST. Roll out of ‘AIS for Taxpayer’ Mobile App. Last date for linking of PAN-Aadhaar extended. Consequences of PAN becoming inoperative as per the newly substituted rule 114AAA. CBDT Signs 95 Advance Pricing Agreements in FY 2022-23. Rs.1,60,122 crore gross GST revenue collected for March 2023. 960(E), dated 30th December, 2019.Ĭlick here to download Income –Form Sahaj (ITR-1) and Sugam (ITR-4) for A.Y. Rules, 2019, vide notification number GSR. Note : The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide notification number S.O.969(E), dated the 26th March, 1962 and last amended by the Income-tax (16th Amendment) In the principal rules, in Appendix II, for Form “Sahaj (ITR-1)” and “Sugam (ITR-4)”, the following Forms shall, respectively, be substituted, namely:. (b) in sub-rule (5), for the figures “2018”, the figures “2019” shall be substituted. (ii) in the proviso, after item (V), the following item shall be inserted, namely:- “(VI) owns a house property in joint-ownership with two or more persons.”

E-Verification Scheme of CBDT is another initiative facilitating voluntary compliance. Advisory for the taxpayer wishing to register as One Person Company in GST. Roll out of ‘AIS for Taxpayer’ Mobile App. Last date for linking of PAN-Aadhaar extended. Consequences of PAN becoming inoperative as per the newly substituted rule 114AAA. CBDT Signs 95 Advance Pricing Agreements in FY 2022-23. Rs.1,60,122 crore gross GST revenue collected for March 2023. 960(E), dated 30th December, 2019.Ĭlick here to download Income –Form Sahaj (ITR-1) and Sugam (ITR-4) for A.Y. Rules, 2019, vide notification number GSR. Note : The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide notification number S.O.969(E), dated the 26th March, 1962 and last amended by the Income-tax (16th Amendment) In the principal rules, in Appendix II, for Form “Sahaj (ITR-1)” and “Sugam (ITR-4)”, the following Forms shall, respectively, be substituted, namely:. (b) in sub-rule (5), for the figures “2018”, the figures “2019” shall be substituted. (ii) in the proviso, after item (V), the following item shall be inserted, namely:- “(VI) owns a house property in joint-ownership with two or more persons.”

(VIII) is required to furnish a return of income under seventh proviso to sub-section (1) of section 139.” “(VII) owns a house property in joint-ownership with two or more persons or (ii) after item (VI), the following items shall be inserted, namely:. (i) in item (V), the word “or” occurring at the end shall be omitted

(I) in the opening portion, for the figures “2019”, the figures “2020” shall be substituted In the Income-tax rules, 1962 (hereinafter referred to as the principal rules), in rule 12,. (2) They shall come into force with effect from the 1st day of April, 2020. Short title and commencement.-(1) These rules may be called the Income-tax (1st Amendment) Rules, 2020. 9(E).-In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:.

0 kommentar(er)

0 kommentar(er)